State Budget

State investments in high-quality pre K-12 and higher education, health care, and infrastructure help communities flourish as Texas continues to grow. Our state budget is a moral document that should reflect the needs of Texans from all backgrounds and help every Texan thrive.

Background

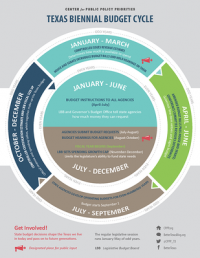

The state budget process in Texas is a two-year cycle that results in a two-year, or “biennial,” appropriations act crafted primarily by the legislature. The second year of the budget often undergoes significant changes, with supplemental spending bills needed each legislative session to address deliberate underfunding or natural disasters.

In odd-numbered years, the comptroller estimates how much revenue is available to spend, the House and Senate propose budget bills, a final compromise is reached for the next two years, and state agencies develop operating budgets for even-numbered years. In even-numbered years, budget requests are drafted and submitted.

Our Staff

Dick Lavine

Senior Fiscal Analyst, Invest in Texas

Shannon Halbrook

Senior Fiscal Analyst, Invest in Texas

Samuel Cervantes

Analyst, Data & Policy