The Affordable Care Act Marketplace Significantly Increases Access to Health Coverage in Texas

In Texas, a little more than 1 million people bought coverage for 2019 through the Health Insurance Marketplace established by the Affordable Care Act (ACA, or ObamaCare), making the ACA the main reason our state’s uninsured rates have improved since 2013. On the Healthcare.gov website, Texans can shop around and buy health insurance directly from a health plan if they don’t otherwise have coverage through their employer or a government program like Medicaid or Medicare. By providing this new option to buy directly from health plans, the Affordable Care Act Marketplace has become an essential part of our health insurance system and a stable individual health insurance market. People and families purchase coverage from an insurer, which is critical to the success of this system.*

Texas Marketplace Enrollment Declines, Uninsured Numbers Increase

Unfortunately, the number of Texans enrolled for 2019 coverage in the Affordable Care Act Health Insurance Marketplace decreased for the second year in a row, with about 40,000 fewer people selecting a plan during open enrollment. This is a 3.5 percent drop in enrollment for 2019 plans compared to 2018, which is just slightly below the national average of a 3.8 percent decline. Texas’ federal Navigator funds were cut from $9.2 million in 2016 to just $1.4 million in 2018, an 85 percent reduction. Considering these active efforts by Congress and the Trump Administration to undermine the Marketplace, the modest enrollment decrease was better than many expected. But any decline in coverage is especially bad news for Texas, where we have the nation’s highest uninsured rate — and it’s getting worse.

Hidden within Texas’ statewide enrollment figures are substantial differences among Texas communities in different regions. The insurers offering coverage and the prices they charge vary across Texas regions, as do average incomes and other population characteristics including immigration status. Official Marketplace data from the Centers for Medicaid & Medicare Services’ 2019 Exchange Open Enrollment Period Final Report includes county-level enrollment numbers that allow insight into regional differences in enrollment trends. The table below shows Marketplace enrollment numbers for Texas’ 10 most populous counties (sorted by percent change from 2018 to 2019).

As the table shows, Texas counties saw significant regional differences in enrollment. For example, Tarrant County had almost no change in enrollment, but Bexar County had an almost 11 percent decrease. Without taking on a comparative analysis of all Texas regions, let’s focus on one region as a case study: the Gulf Coast.

A Tale of Two Counties: Local Efforts Make a Difference

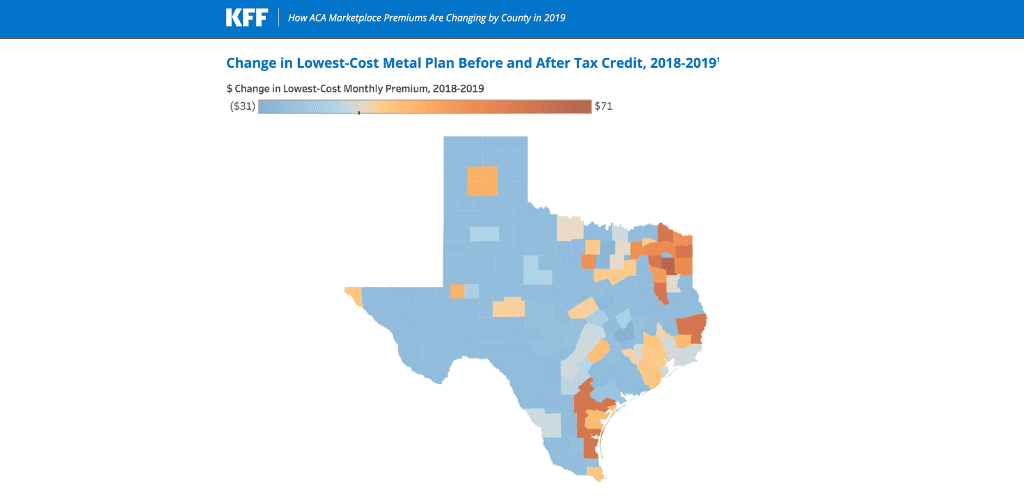

Harris County and Montgomery County cover a large portion of the Houston metro area and border each other. Both counties had relatively large increases in premiums in 2019 compared to other large urban counties. Among the most populous Texas counties, Montgomery County also had the largest decrease in enrollment this year of almost 11 percent (tied with Bexar county). Harris County, on the other hand, only saw a one percent decrease in enrollment.

Below are some of the best practices happening in Harris County that could have contributed to the county having far fewer plan participants drop coverage. Other localities should consider these to improve Marketplace enrollment in their region:

- Partner with outreach and enrollment entities to provide sustained financial and administrative support for their efforts, including enrollment and post-enrollment assistance.

- Engage in myth-busting public education efforts to equip immigrants and their families with accurate information on how new immigration proposals affect use of health care, and with referrals to immigration law services that can help them make decisions based on their particular situations.

- Work with hospital districts and local non-profit health plans to explore the possibility of creating premium assistance programs for people using local indigent health programs. Promote the creation of no-deductible, low out-of-pocket cost health plans to increase affordable coverage.

- Work with the local office of the nationwide federally funded Ryan White AIDS/HIV program to explore a premium assistance program for Ryan White clients.

Read more about these regional differences and best practices.

There are major gaps in access to affordable, comprehensive health coverage for Texans that will only be solved with the active engagement of Congress and the Texas Legislature. In the meantime, local community-based efforts to support marketing, outreach and enrollment in health care have proven successful in Texas. Working to spread these best practices could help slow or offset the enrollment decline trend in future years.

For more detail, read the full report.

* Individual market coverage can also be purchased directly from a health plan—outside of the Affordable Care Act Marketplace—but only for Texans who don’t need federal subsidies to make their insurance affordable.