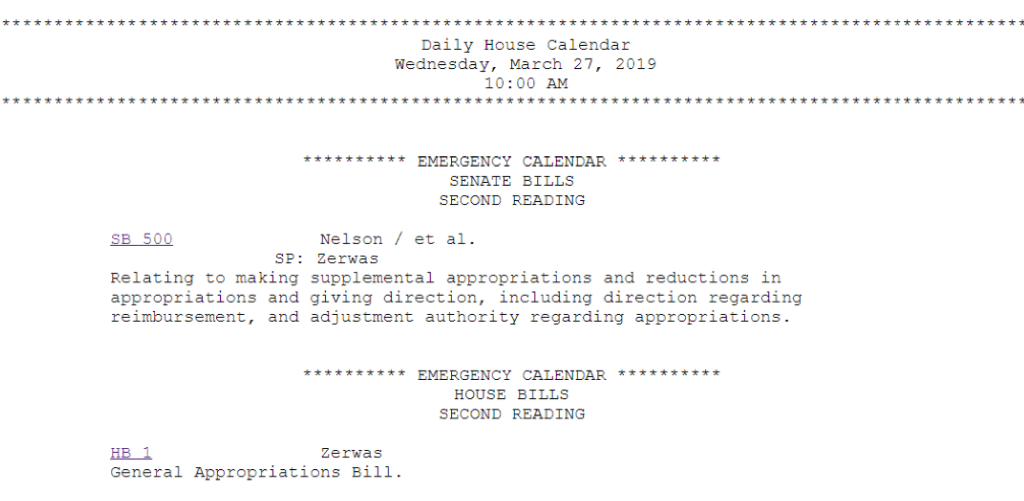

It’s show time in the Texas House of Representatives. The only bill the Legislature is required to pass – the state budget – will be up for debate on Wednesday, March 27. Members will discuss and amend the 2020-2021 state budget proposal (House Bill 1), along with a supplemental spending plan to cover extra expenses for 2019 and 2020-2021 (Senate Bill 500). Lawmakers have filed more than 300 amendments to HB 1, and these amendments carry major implications for access to education, health care and other key programs that affect every Texan.

Here are five things to put the House’s state budget debate in context:

A.) The numbers. The budget-writing House Appropriations Committee adopted a 2020-2021 proposal that would spend $251 billion in state and federal funds. This “All Funds” amount includes $2.3 billion from the Economic Stabilization Fund (usually called the Rainy Day Fund), much of it for one-time uses such as state behavioral health hospital construction. Compared to the 2018-2019 budget, All Funds spending would grow more slowly than population and inflation (the Consumer Price Index). The same is true of the $116.5 billion in proposed “General Revenue” spending, the part of the budget that state taxes mostly cover. HB 1 has important, new state funding for public schools. If it were not for that new school funding, adjusted General Revenue spending would actually decrease by more than eight percent over the previous two-year budget cycle. This would mean that– just as in 2017 – local taxes would shoulder the responsibility for schools and other public services needed by a rapidly growing population while the state invests less.

B.) The supplemental. In Senate Bill 500, the House makes changes to the 2018-2019 budget, adding $7.2 billion in spending through August 31, 2019. SB 500 also proposes $2.1 billion for state services in 2020-2021, mainly for public education and teacher and state employee retirement. The 2019 spending includes funds needed because of damage and recovery costs from Hurricane Harvey, which struck after the 2017 legislative sessions had concluded. But SB 500 also contains $2.1 billion in General Revenue and $2.3 billion in federal funds needed to pay for the remainder of 2019’s Medicaid bills, which the 2017 Legislature chose to postpone for a 2019 supplemental bill. Texas will likely always need to make supplemental appropriations, because our budget is so large and covers 24 months. The important thing is to recognize the true costs of operating state government, by taking into account the additional supplemental funds that are needed to keep the government from shutting down before the end of the year.

C.) The good. The 2020-2021 House Appropriations budget proposal, like its “starting-point” version from January 2019, still includes $9 billion more in General Revenue for public schools than current law would have required. This is welcome news and critically needed to ensure all Texas children have access to a quality education. How much of this makes it into the final budget conference committee report, and how lawmakers use it, depends on the fate of House Bill 3 or other school finance legislation lawmakers are debating in the House and Senate. House budget writers also wisely tried to address long-standing needs in retired teachers’ health care, community-based long-term care, behavioral health, foster care, adult protective services, and higher education.

D.) The bad. Over $6 billion in General Revenue requests by state agencies for the 2020-2021 budget ended up in the dreaded “Article XI” of HB 1. Any items in Article XI of the state budget proposal often end up going nowhere. While some dismiss these requests as wish list items, unfunded budget items include major costs that will inevitably show up in a 2021 supplemental proposal, such as medical cost growth in Medicaid and the Children’s Health Insurance Program. Anticipated caseload growth for Medicaid and CHIP is funded in the House budget proposal, but as the Legislative Budget Board summary states, “Full funding for anticipated increases in cost due to medical inflation, higher utilization, or increased acuity is not included.” As the House debates HB 1, many amendments will end up in Article XI, adding to the tally of unfunded state services.

E.) Economic Stabilization Fund. Combining the amounts in SB 500 and HB 1, the House proposes using $6.6 billion from the ESF, which the Comptroller had projected would grow to almost $15.4 billion by 2021 if unspent. The House proposal would mean that the ESF would contain $8.4 billion by 2021, still well above the $7.5 billion minimum balance required for oil and gas severance tax transfers to keep going to the State Highway Fund. CPPP supports wise expenditures like these from the ESF, which is meant to fill funding gaps and balance out the state budget.

What’s next?

House members will try to amend the budget proposals in the debate that starts on Wednesday. It will be an exciting evening, since members can offer all sorts of amendments to the pre-filed amendments. In the Senate, on the other hand, floor amendments to the Finance Committee’s proposal are not made. House floor amendments can reduce, but are not allowed to add to, the total General Revenue or ESF spending proposed in the budget bills. Federal funds for state services could also be at stake in some of the proposed amendments, which could be increased or decreased by General Revenue amendments that alter state matching amounts, or affect federal grants like disaster aid.

Looking Closely at the Amendments

Of the hundreds of amendments, CPPP is pushing for three that could make a big difference in the lives of Texans.

- A Medicaid expansion amendment by Rep. John Bucy could boost health care access to over 1 million Texans lacking health insurance and grow state revenue by $9 billion a year.

- A small investment in a kinship navigator system through Rep. Carl Sherman’s proposed budget rider could bring in matching federal dollars and help families who step up to take care of relatives’ children.

- A Census 2020 outreach funding budget rider by Rep. César Blanco could help reduce an undercount in the upcoming Census, which is crucial to representation at all levels of government, federal funding, accurate data, and business investment in Texas. CPPP strongly supports these investments in our future.

We’ll also be watching for bad amendments such as those that, in past House debates, further underfund or limit access to services such as women’s health. There will also be amendments that do not alter funding levels but merely target some state services for cuts for ideological reasons.

We will have live analysis during the Texas House debate on Wednesday. Look for more analysis of the final House budget and how it compares to the Senate’s proposal in the weeks ahead, as the Senate wraps up its version and the conference committee process begins. Most likely, the biggest difference will continue to be found in the two chambers’ proposals for state aid to school districts, charter schools, and the more than 5 million Texas schoolchildren they educate.

The final 2020-2021 budget compromise will affect every Texan since it touches state-supported public higher education, health care, highways, public safety, environmental protection, and other services.