We hear plenty from elected leaders about Texas being a “low-tax state,” but we are actually a high-tax state for many families. By setting up a tax system that puts financial strain on lower-income Texans, state leaders are in effect widening the income equity gap and making it harder for low-wage families to work their way out of poverty.

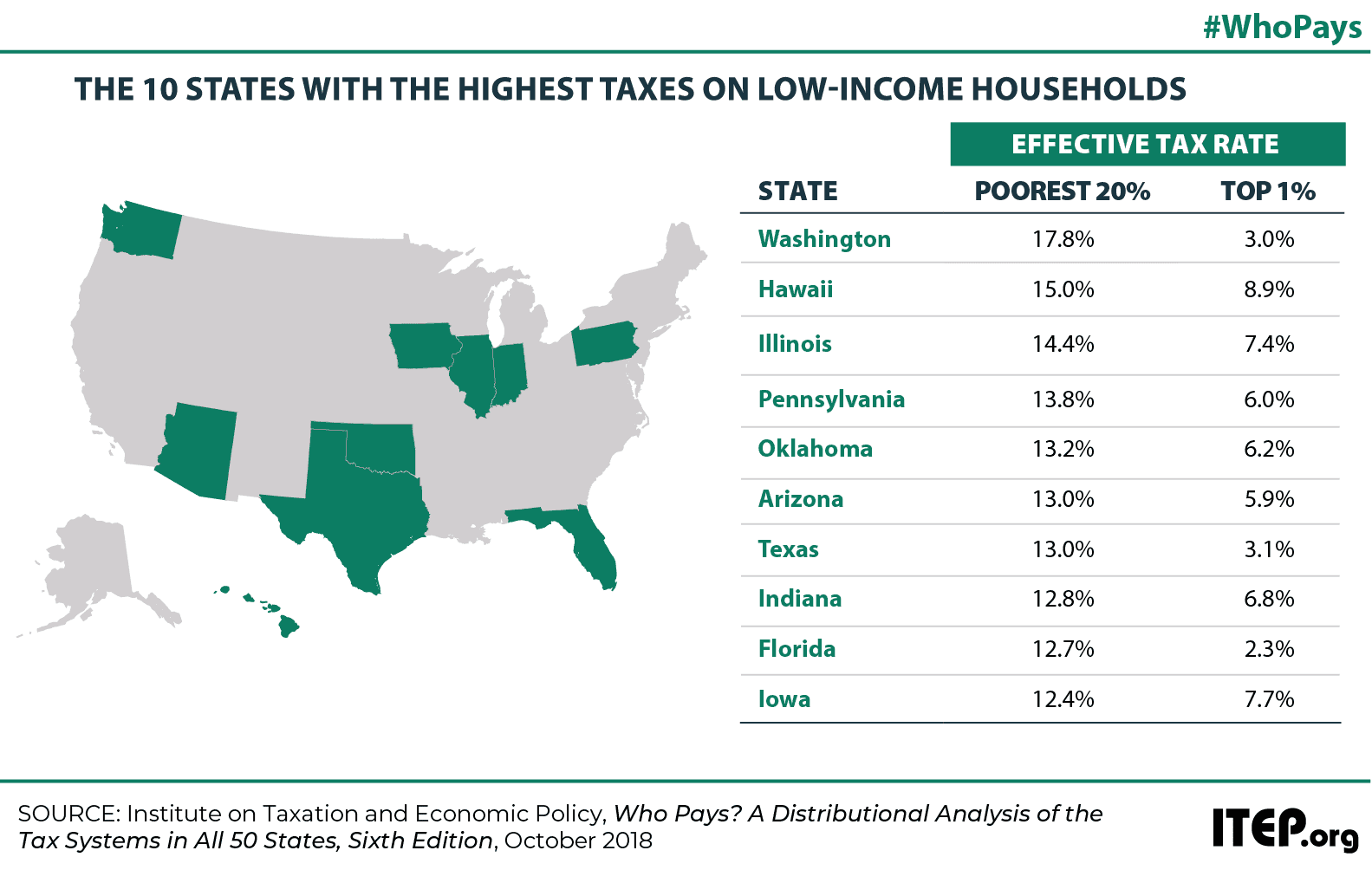

A new national study of state and local tax systems says Texas has the second most unfair system in the country.

Here’s one way to think about it: Families at the top of the income ladder receive 20 percent of all personal income in Texas, but pay only 8.5 percent of all state and local taxes. Families at the bottom of the scale receive only three percent of all income, but pay 5.7 percent of all taxes.

This means that incomes in Texas are even more unequal after people pay state and local taxes than before they pay. This totally backward tax structure holds back families already struggling to put food on the table.

Looking at it from a different angle: In Texas, before paying state and local taxes, the top one percent of taxpayers earn an average income of $1.6 million – 124 times more than the state’s poorest 20 percent of residents, whose annual income averages only $13,000.

After paying state and local taxes, the average after-tax income of Texas’ top earners is 140 times the size of the average after-tax income of the state’s lowest-income residents. This is an unfair result of a system that charges a higher tax rate to lower-income families than to those with higher income. Texas is in therefore expanding the income equity gap through its tax policy.

According to the new ITEP study, the tax bill for the lowest-income 20 percent of Texas families is the sixth highest state and local tax bill in the country for this income group. But for the top one percent of households, the tax bill is remarkably the ninth lowest.

Texas leaders should remove the barrier to opportunity that our unfair tax system poses. For instance, the Legislature could expand the sales tax to cover business and professional services, such as legal, accounting, and financial securities brokerage services, which are used primarily by higher-income households. Lawmakers could repeal the optional percentage homestead exemption from school property taxes, which benefits primarily wealthier homeowners. The savings from the repeal could go to schools statewide. Finally, the Legislature must avoid exacerbating the problem with further cuts to the franchise or margins tax, the state’s main business tax.

A fair opportunity to move up the economic ladder is a promise that Texas makes to all who live here, but we aren’t keeping this promise. Many Texas families encounter barriers to opportunity that they can’t overcome through hard work at multiple low wage jobs. By improving the fairness of our state and local tax system, we can improve the opportunity for all Texans to compete and succeed in life.